Enterprise Spend Management Optimized

Optimize Spend is a leading enterprise spend management software solution

Globally, it gives you the clarity you need to take control of all your market data, research, software and other corporate subscription spend across the enterprise. Saving you time and money!

Optimize Spend is a true best-of-breed solution bringing together the best of 20 years of FITS and INFOmatch — with major new capabilities.

Secure compliance with your data vendor agreements

Understanding in-house consumption of vendor data and ensuring compliance with the terms & conditions of your enterprise subscription agreements can be challenging. Particularly for firms managing large volumes of contract clauses across hundreds of suppliers. Our expense management solutions create full transparency around the access to —

Save 2-30% off your annual enterprise subscription costs

Today’s business is often stretched thin with the rising cost of data and the constant internal pressure to drive efficiency while reducing overall enterprise subscriptions spend. Optimize Spend provides a single repository of all subscriptions, and automates many previously resource intensive processes. Our clients realize annual cost savings ranging from 2%-30%.

Gain total cost transparency & control of subscriptions and vendor relationships

Many firms struggle to streamline and bring transparency & control to their enterprise subscriptions. Our inventory system provides a central platform to store information about all your vendor relationships, product information, contractual terms, a catalogue of services used by each employee for cost allocation, full audit trail, and more.

Optimize your enterprise spend management

Many financial institutions, law firms, and professional services firms – large and small – struggle to understand and control the contracts, billing and expenses for their enterprise subscriptions. Our spend management platform Optimize Spend solves this problem.

How to manage & optimize spend on services used across your organization?

In today’s subscription economy, firms consume a broad range of services in order to meet their complex business needs. Many of these firms still rely on complex spreadsheets or other tools supporting manual processes to manage their subscriptions.

By automating inventory management across the range of subscription services, firms can eliminate these manual systems and save time, money and resources.

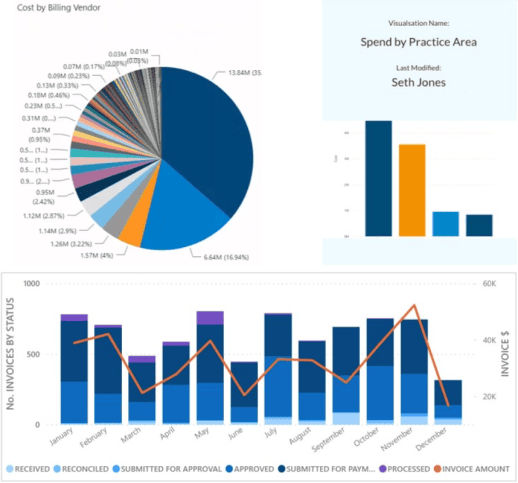

Automating inventory control allows firms to analyze existing costs and predict upcoming spend relating to information and subscription services consumed across the enterprise. This in turn supports accurate reporting of usage and cost data to your users, financial controllers and auditors.

It allows you to deliver on cost transparency, and manage risk and compliance. Finally, this approach supports supplier negotiations with evidence-based intelligence, helping to optimize contract renewals.

How we can help you

Why achieve a “single view” into enterprise spend management?

Employees come and go at every firm. Also, users may be too busy to indicate that they no longer need services that were previously important to their role. Understanding the services and users governed by the contracts equips managers to make informed decisions about each contract and know when it’s time to negotiate with the vendor.

A “single view” solution proactively and electronically polls the user community about current service requirements, facilitating cost containment and reduction. This alleviates the data manager from expending valuable time pursuing each user and leaves more time to examine the “big picture”.

A single view of costs & expenses also allows to accurately allocate costs across users, departments, etc. to truly understand profitability.

How to deal with increasing regulatory requirements while driving efficiency?

As regulators and auditors push for more accurate reporting and vendor contract compliance, seeing the “big picture” without a consolidated view of enterprise subscriptions is a challenge.

Enterprise spend management can be made more efficient through data consolidation, intelligent automation and processes such as managed services. As regulators and auditors look for increased transparency into business operations, automated solutions also provide a much-needed audit trail.

With a central system for enterprise inventory & cost management, firms often see a reduction in costs from 2 to 30%. Savings are achieved through cutting annual duplicate service fees as well as reduced headcount toward invoice processing, contract management, reporting, and more.

How we can help you

500+ happy customers world-wide

Jointly managing over $8,5 billion in enterprise subscriptions. And yes, we’re pretty proud of our 96% retention rate since 1990.

Ready to professionally manage your enterprise subscriptions spend?

Learn how you can optimize your subscriptions spend.

How Optimize Spend can help you?

Our solution serves several types of organizations and support many departments

A deep dive into all the spend management processes our solution optimizes

Get in touch

Optimize Spend serves several types of organizations and supports many departments. Whether you are an international investment bank or a smaller asset manager, a hedge fund or a broker, a data vendor sourcing market data, a professional service organization or a blue-chip company — Optimize Spend enables any firm to optimize their enterprise subscription spend.

Get in touch

Ready to optimize your enterprise subscription spend & usage?

ROI calculatorBlog & news

Contact us

United States (Global HQ)

1 Pennsylvania Plaza

3rd Floor

New York, NY 10119

All international offices- Privacy policy

- Copyright © 2024 TRG Screen